calendar 2026 financial year represents a significant subject within its field, encompassing a range of practices, traditions, or applications that shape daily life and broader cultural or professional landscapes. Understanding this specific financial cycle provides clarity about its background, its present relevance, and the way it continues to influence various aspects of society. The upcoming fiscal period, which includes or commences in calendar year 2026, is a critical juncture for strategic planning, economic forecasting, and operational adjustments across numerous sectors. This article explores the multifaceted dimensions of this period, from its fundamental definitions to its practical applications and the challenges it presents, offering a comprehensive overview for businesses, governments, and financial professionals alike.

Definition and Origin of the 2026 Financial Year

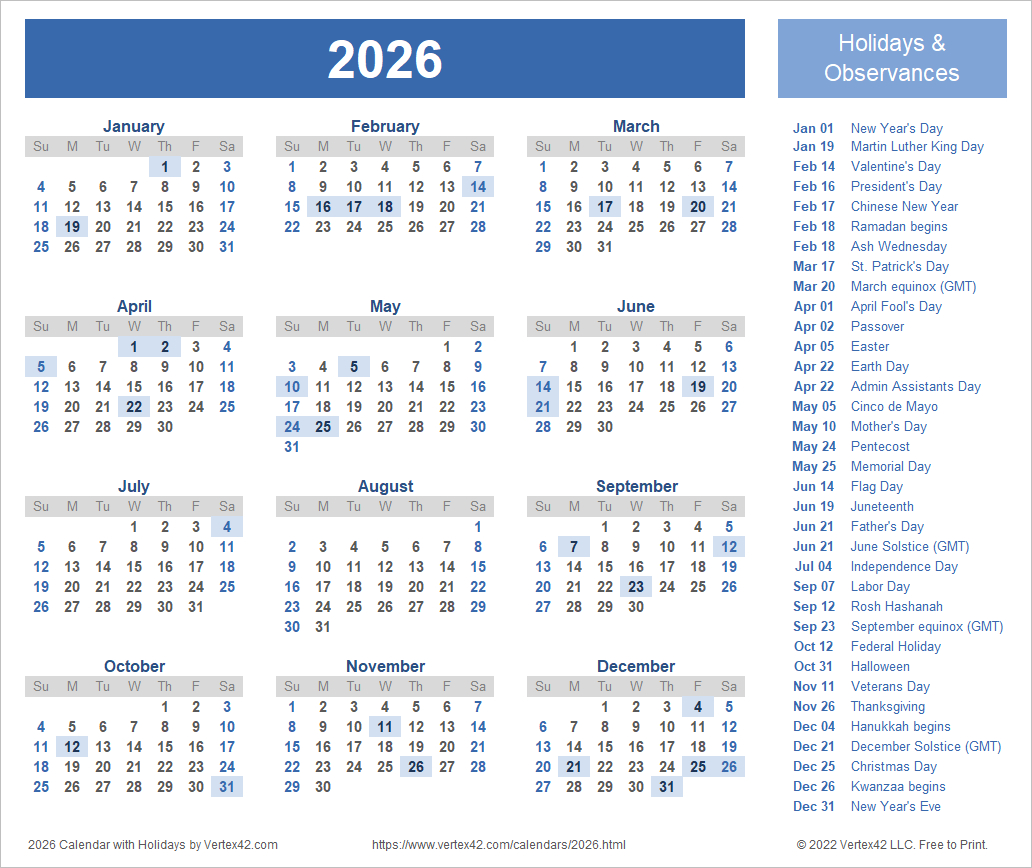

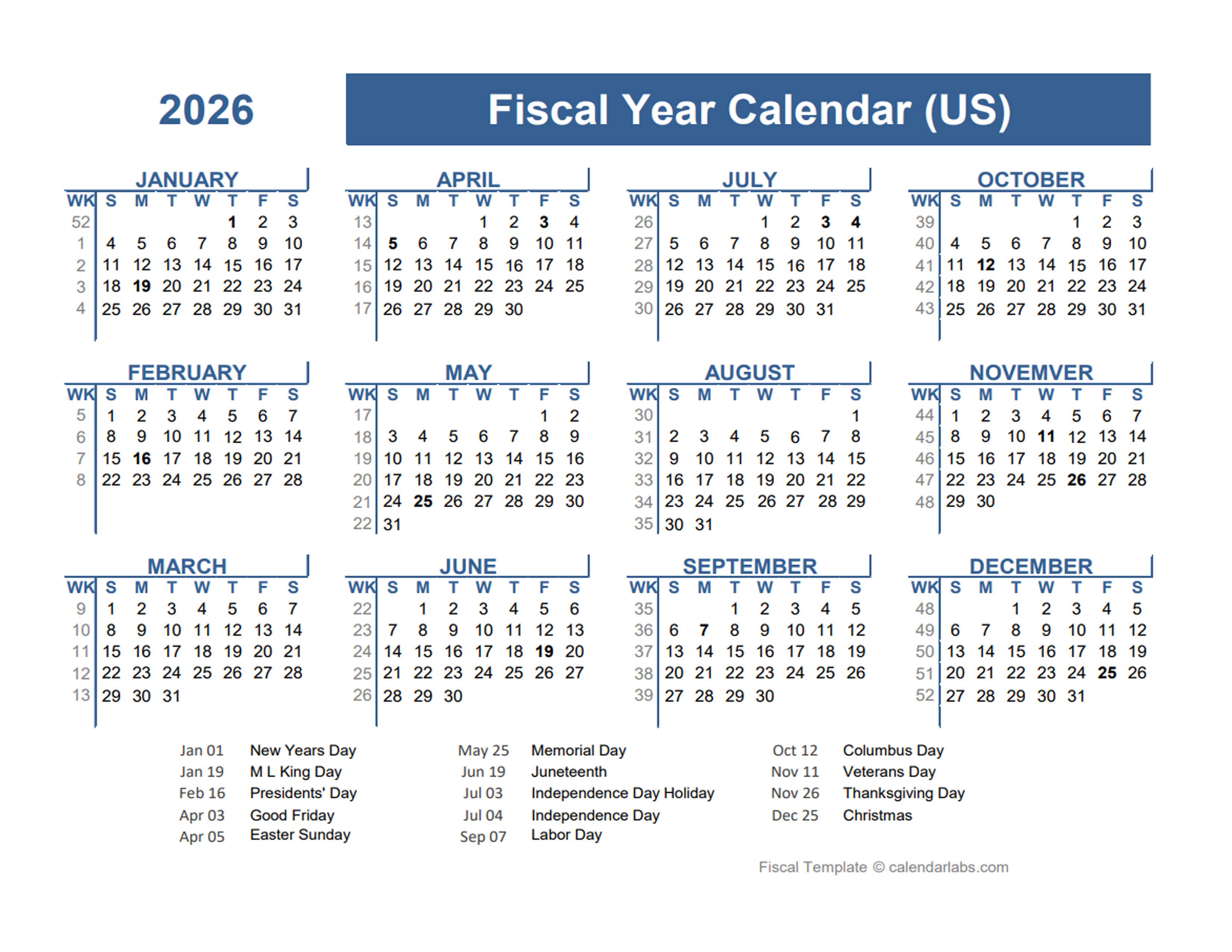

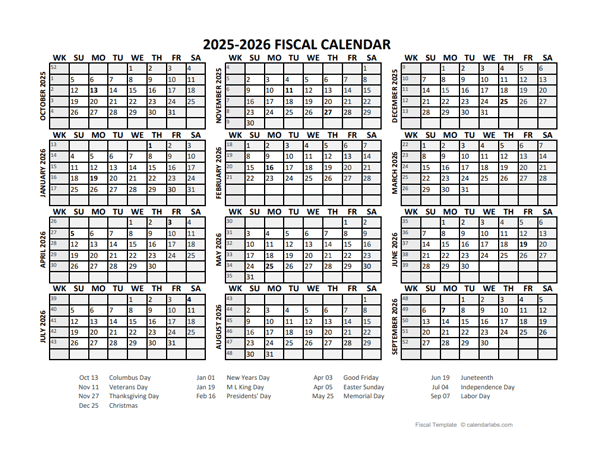

A financial year, often referred to as a fiscal year, is a 12-month period used by governments, businesses, and other organizations for accounting purposes and to prepare financial statements. Unlike the standard calendar year (January 1 to December 31), a financial year can begin and end on any date, provided it comprises 12 consecutive months. The choice of a fiscal year end often aligns with operational cycles, industry norms, or tax regulations. For instance, many countries, including the United States, use a fiscal year that starts on October 1 and ends on September 30 for government budgeting. The United Kingdom and Canada often use an April 1 to March 31 cycle, while many businesses globally align with the calendar year.

When discussing the financial year encompassing 2026, it is crucial to recognize this variability. It could refer to:

- A fiscal year that starts in 2026 (e.g., January 1, 2026 – December 31, 2026, or April 1, 2026 – March 31, 2027).

- A fiscal year that ends in 2026 (e.g., October 1, 2025 – September 30, 2026, or July 1, 2025 – June 30, 2026).

- A fiscal year that spans 2026 (e.g., a fiscal year starting in mid-2025 and ending in mid-2026, or starting in mid-2026 and ending in mid-2027).

The concept of a standardized financial reporting period emerged from the necessity for systematic record-keeping, taxation, and performance evaluation. Historically, financial reporting was often sporadic and inconsistent, making it difficult for rulers to collect taxes efficiently or for merchants to assess their profitability accurately. The formalization of the fiscal year provided a structured framework for governments to manage national budgets and for businesses to track their financial health, facilitating economic planning and ensuring accountability. This structured approach became increasingly vital with the rise of modern commerce and complex tax systems, establishing the fiscal year as a cornerstone of financial governance worldwide.

Importance of the 2026 Financial Year Today

The significance of the 2026 financial year cannot be overstated, particularly in an increasingly dynamic global economy. For entities ranging from multinational corporations to small enterprises and governmental bodies, this period serves as a critical benchmark for numerous strategic functions. Firstly, it is fundamental for strategic planning and goal setting. Organizations use the defined boundaries of this fiscal period to establish annual objectives, allocate resources, and develop operational roadmaps. This structured approach allows for clear targets to be set for revenue growth, cost reduction, market expansion, and product development, providing a measurable framework for progress.

Secondly, the upcoming financial year is crucial for budgeting and financial forecasting. Governments construct national budgets that dictate public spending on infrastructure, social programs, and defense, all within the confines of their fiscal year. Similarly, businesses create detailed budgets to manage expenditures, project revenues, and ensure liquidity. Accurate forecasting for this period is essential for anticipating market trends, managing cash flow, and making informed investment decisions, thereby mitigating financial risks and optimizing resource utilization.

Thirdly, compliance and regulatory reporting heavily rely on the defined fiscal period. Tax authorities require annual financial statements and tax returns based on the fiscal year. Publicly traded companies must adhere to stringent reporting standards, submitting quarterly and annual reports to regulatory bodies and shareholders. These reports provide transparency into an entity’s financial performance and position, enabling investors to make informed decisions and ensuring adherence to legal and ethical standards. The 2026 fiscal period will be subject to prevailing tax laws and accounting standards, necessitating careful adherence to avoid penalties and maintain stakeholder trust.

Finally, the financial year provides a standardized basis for economic analysis and performance evaluation. Economists, analysts, and investors use fiscal year data to assess economic health, identify sectoral trends, and evaluate the performance of individual companies. This comparative analysis over successive fiscal periods allows for the identification of growth patterns, periods of stagnation, or decline, offering valuable insights into overall economic trajectories and the effectiveness of business strategies. The data generated during the 2026 fiscal period will thus contribute significantly to broader economic narratives and future policy decisions.

Benefits of the 2026 Financial Year

The structured approach offered by a defined financial year, such as the one encompassing 2026, provides a multitude of benefits for various stakeholders. One primary advantage is enhanced clarity and consistency in financial reporting. By standardizing the reporting period, organizations ensure that financial data is comparable across different years and with industry peers. This consistency simplifies the analysis of trends, performance metrics, and financial health over time, making it easier for internal management, investors, and regulators to understand an entity’s financial narrative.

Another significant benefit is improved accountability. A defined fiscal period creates clear benchmarks against which performance can be measured. Managers and departments are held accountable for achieving budgetary targets and operational goals within this specific timeframe. This fosters a culture of responsibility and efficiency, as performance reviews and compensation structures are often tied to the outcomes of the financial year. The transparency afforded by annual reports further reinforces this accountability to shareholders and the public.

Furthermore, the 2026 fiscal period facilitates more accurate forecasting and risk management. By systematically reviewing past performance and current economic indicators within a fixed 12-month cycle, organizations can develop more reliable financial projections. This forward-looking perspective enables proactive identification of potential financial risks, such as cash flow shortages, market downturns, or increased operational costs. With these insights, entities can implement mitigation strategies, adjust budgets, and secure necessary financing, thereby enhancing their resilience against unforeseen challenges.

The financial year also supports strategic resource allocation. With a clear understanding of projected revenues and expenditures for the upcoming period, organizations can optimize the deployment of their capital, human resources, and operational assets. This ensures that investments are aligned with strategic objectives, maximizing returns and minimizing waste. Whether it is investing in new technology, expanding into new markets, or enhancing employee training, decisions made during the 2026 fiscal period will have a direct impact on long-term growth and sustainability.

Finally, the standardization provided by the fiscal year enables effective comparative analysis. Businesses can benchmark their performance against industry averages, competitors, and their own historical data. This allows for the identification of areas of strength and weakness, informing strategic adjustments and competitive positioning. For governments, it permits the evaluation of economic policies and the effectiveness of public spending programs against previous years or international standards, driving continuous improvement in governance and public service delivery.

Applications of the 2026 Financial Year

The utility of a defined financial year, such as the one covering 2026, extends across diverse sectors and functions, underpinning critical operations and decision-making processes. In corporate finance, the upcoming fiscal period is the bedrock for annual budgeting, capital expenditure planning, and revenue forecasting. Companies meticulously plan their investments in research and development, marketing campaigns, and infrastructure upgrades, all within the context of their fiscal year budget. It also dictates the timing for dividend declarations, share buybacks, and debt management strategies, influencing investor relations and market valuation.

For government finance, the 2026 fiscal period is paramount. National, state, and local governments formulate their annual budgets, outlining projected tax revenues and planned expenditures on public services, defense, education, and healthcare. This period defines the tax collection cycle and the allocation of funds to various departments and programs. Legislative bodies review and approve these budgets, ensuring fiscal responsibility and adherence to public policy objectives. Economic indicators and policy adjustments are often evaluated based on their impact within a given fiscal year.

Non-profit organizations also rely heavily on the financial year for their operational and funding cycles. Grant applications, fundraising campaigns, and program evaluations are typically structured around the fiscal period. It allows them to track donor contributions, manage program expenses, and report on their impact to funders and beneficiaries, ensuring transparency and accountability in their mission-driven activities. The 2026 fiscal period will be crucial for these organizations to secure funding and deliver on their social objectives.

At an individual level, while personal finances are often managed on a calendar year basis, the principles of the financial year indirectly influence decisions. Tax planning for individuals is directly tied to the tax year, which for many aligns with the calendar year but can vary. Investment decisions are also influenced by corporate fiscal year reports, as these provide the data necessary for assessing company performance and potential returns. Understanding the broader economic context set by the 2026 fiscal period can inform personal financial strategies, from savings goals to retirement planning.

Moreover, the financial year plays a critical role in economic policy and analysis. Central banks and government agencies use fiscal year data to monitor economic growth, inflation, and employment rates. This information is vital for formulating monetary policy, implementing fiscal stimuli, or making adjustments to interest rates. International organizations also leverage fiscal year data from member states to conduct global economic assessments and provide recommendations for sustainable development and financial stability. The collective financial activities within the 2026 fiscal period will thus contribute to a comprehensive understanding of global economic health.

Challenges and Future of the 2026 Financial Year

Navigating the 2026 financial year presents a unique set of challenges, while also offering opportunities for innovation and adaptation. One significant hurdle is economic volatility. Global events, such as geopolitical tensions, supply chain disruptions, and fluctuating energy prices, can introduce considerable uncertainty into financial forecasts. Inflationary pressures, potential recessions, or unexpected market shifts can rapidly alter revenue projections and cost structures, requiring organizations to maintain agility and robust contingency plans throughout this fiscal period.

Another challenge stems from evolving regulatory landscapes. Tax laws, accounting standards (e.g., IFRS, GAAP), and industry-specific regulations are subject to frequent changes. Staying abreast of these updates and ensuring compliance for the 2026 fiscal period demands continuous monitoring and adaptation of financial processes and reporting systems. Non-compliance can lead to significant penalties, reputational damage, and operational disruptions, making meticulous attention to regulatory developments essential.

Technological disruption also poses both a challenge and an opportunity. The rapid advancements in artificial intelligence (AI), machine learning, and automation are transforming financial operations. While these technologies can enhance efficiency, accuracy, and analytical capabilities, their implementation requires substantial investment, upskilling of staff, and careful integration with existing systems. Cybersecurity threats also escalate with increased digitalization, making data security a paramount concern for financial data during the 2026 fiscal period.

Looking to the future, the financial year will likely see several key trends. There will be a greater emphasis on real-time financial reporting and analytics. As technology advances, the ability to access and analyze financial data instantaneously will become more prevalent, moving beyond traditional periodic reporting. This will enable more dynamic decision-making and quicker responses to market changes.

Furthermore, sustainability reporting and ESG (Environmental, Social, and Governance) metrics will gain even greater prominence. Stakeholders are increasingly demanding transparency on an organization’s impact beyond purely financial performance. The 2026 fiscal period will likely see more companies integrating ESG data into their annual reports, reflecting a broader commitment to responsible business practices and long-term value creation.

Finally, the future will demand greater financial resilience and adaptability. Organizations will need to build robust financial models that can withstand economic shocks and rapidly pivot strategies in response to unforeseen events. This includes diversifying revenue streams, optimizing cost structures, and maintaining healthy liquidity levels. The experiences and lessons learned during the 2026 fiscal period will undoubtedly shape future financial planning and risk management strategies, fostering a more resilient global financial ecosystem.

FAQs about the 2026 Financial Year

Q1: What is the 2026 financial year?

A1: The 2026 financial year refers to a 12-month accounting period used by organizations for financial reporting, budgeting, and taxation, which either starts, ends, or spans across the calendar year 2026. Its specific start and end dates vary depending on the entity’s jurisdiction, industry, or internal operational cycles.

Q2: Why is the 2026 financial year important?

A2: It is important because it provides a structured framework for strategic planning, budgeting, financial forecasting, and compliance. It allows organizations to set measurable goals, manage resources effectively, meet regulatory obligations, and assess performance against clear benchmarks, contributing to informed decision-making and economic stability.

Q3: What are the main benefits of the 2026 financial year?

A3: Key benefits include enhanced clarity and consistency in financial reporting, improved accountability for financial performance, more accurate forecasting and risk management, optimized strategic resource allocation, and the ability to conduct effective comparative analysis against historical data and industry peers.

Q4: How can the 2026 financial year be applied in daily life?

A4: While individuals typically use the calendar year for personal finance, the principles of the financial year indirectly influence daily life through government budgeting (affecting public services and taxes), corporate performance (impacting employment and investment opportunities), and economic policy (influencing inflation and interest rates). Understanding it helps in making informed personal financial and investment decisions.

Q5: What challenges are associated with the 2026 financial year?

A5: Challenges include navigating economic volatility (e.g., inflation, recessions), adapting to evolving regulatory changes (tax laws, accounting standards), managing technological disruption (AI, cybersecurity risks), and integrating new demands such as sustainability reporting. These require continuous adaptation and robust financial planning.

Tips for Navigating the 2026 Financial Year

Successfully managing the upcoming financial year requires a proactive and informed approach. Adhering to certain best practices can significantly enhance financial performance and strategic outcomes.

Understand the fundamentals. Begin by clearly defining the specific start and end dates of the financial year for your organization or relevant entities. Familiarize yourself with the applicable accounting standards (e.g., GAAP, IFRS) and tax regulations relevant to your jurisdiction for this period. A solid grasp of these foundational elements is crucial for accurate financial reporting and compliance. This includes understanding revenue recognition principles, expense classification, and asset valuation methods.

Focus on practical use. Beyond theoretical understanding, actively apply the financial year framework to practical aspects of operations. Develop a comprehensive budget that aligns with strategic objectives, allocating resources effectively across departments and projects. Implement robust financial forecasting models to anticipate cash flows, revenues, and expenses. Regularly monitor actual performance against these forecasts, making timely adjustments as economic conditions or operational realities evolve. This proactive management helps in maintaining financial stability and achieving set goals.

Stay updated on new trends or research. The financial landscape is constantly changing. Continuously monitor economic indicators, industry trends, and technological advancements that could impact financial performance during the 2026 fiscal period. This includes staying informed about global economic forecasts, emerging regulatory requirements, and innovations in financial technology (FinTech). Subscribing to industry publications, attending webinars, and engaging with professional networks can provide valuable insights and help anticipate future challenges and opportunities.

Avoid common mistakes. Several pitfalls can undermine financial management. These include inadequate budgeting, failing to regularly review financial performance, neglecting compliance requirements, and making short-sighted decisions without considering long-term implications. Ensure that financial data is accurate and consistent, and that internal controls are robust to prevent errors or fraud. Timely filing of tax returns and financial statements is also critical to avoid penalties and maintain good standing with regulatory bodies.

Adopt a long-term approach. While the financial year provides a 12-month framework, effective financial planning extends beyond this single period. Integrate the 2026 fiscal period into a broader multi-year strategic plan. Consider how current decisions will impact future financial health, sustainability, and growth. This includes planning for capital investments, debt management, and talent development with a long-term vision, ensuring that the organization is positioned for sustained success well beyond the immediate fiscal cycle.

Conclusion about the 2026 Financial Year

The continuing importance of the financial year encompassing 2026 cannot be overstated. It serves as an indispensable framework for structuring financial activities, enabling effective planning, robust reporting, and informed decision-making across all sectors. This specific fiscal period reinforces its cultural, professional, and personal significance by providing a standardized lens through which economic performance can be measured, evaluated, and projected. For businesses, it is the cornerstone of strategic growth and operational efficiency; for governments, it dictates the allocation of public resources and the implementation of policy; and for individuals, it indirectly shapes economic opportunities and personal financial well-being.

While challenges such as economic volatility, regulatory evolution, and technological disruption will undoubtedly test the adaptability of organizations during this time, the benefits of a structured financial year far outweigh these complexities. Its capacity to foster clarity, accountability, and foresight ensures that financial management remains systematic and purposeful. As the global economy continues to evolve, the principles and practices associated with the financial year will remain central to progress and relevance, guiding entities towards sustainable growth and resilience into the future. Embracing its structure with proactive planning and continuous adaptation will be key to navigating the opportunities and complexities of the 2026 fiscal period and beyond.

Leave a Reply